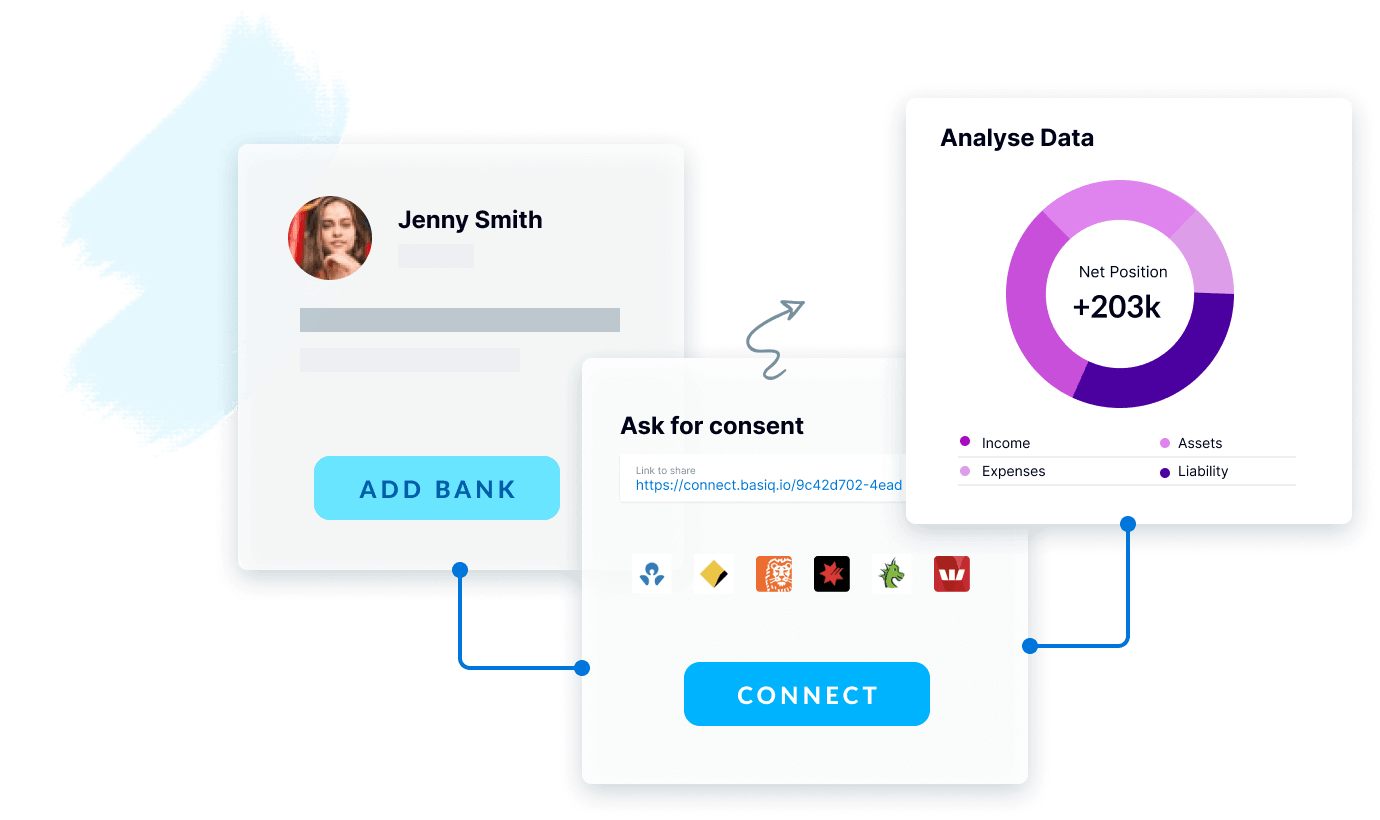

Access account and transaction data in real-time

Connect

Get real-time access to account details, balances and transactions from financial institutions.

Basiq is the leading open banking platform enabling developers to build innovative financial solutions. We provide secure access to customer-consented financial data and powerful APIs that uncover valuable insights.

Questions? Contact our Sales Team

We're powering the future of financial apps and services with

solutions for wealth managers, banks, fintechs, and more.

Basiq provides all the tools you need to optimise customer experiences and transform financial services.

Easily access your customers banking data with enterprise-grade security and managed consent.

Combine financial data from multiple accounts to get a complete view of your customer’s finances.

On-demand retrieval of account balances and new bank transactions.

Identify all sources of income, analyse expenses and discover cash assets and liabilities.

Basiq provides the tools to securely acquire and analyse your customers finances from banks, credit unions, building societies, card issuers and more.

Basiq provides all the essential data you'll need to build a complete picture of your customer's finances.

Retrieve a complete list of accounts held with each institution along with their details and balances.

Acquire historical and current bank transactions from each account.

Verify regular and variable sources of income using our powerful income detection algorithm.

Analyse expenses in detail by observing customer spending across more than 250 categories.

Understand your customer’s current cash reserves, investments and other vital assets.

Identify liabilities such as mortgages and loans, and gain insights into credit card usage behaviour.

Verify the identity associated with each linked institution.

Discover mortgage information such as interest rate, instalment date, loan type and more.

Not ready yet? Talk to an expert

Simple to use, RESTful, and fully documented APIs that help you quickly integrate with your application.

Get a head start with our developer guides, and make your first call to our APIs within a few minutes. Use our fully functional sandbox to test your apps before going live.

Our security approach focuses on security governance, risk management and compliance. This includes encryption at rest and in transit, network security and server hardening, administrative access control, system monitoring, logging and alerting, plus more.

Our physical infrastructure is hosted and managed in a ISO 27001, SOC 1 & SOC 2, PCI Level 1, FISMA Moderate and SOX certified data centres.

Two-factor authentication and strong password controls are required for administrative access to all systems.

Firewalls are utilised to restrict access to systems from external networks and between systems internally.

We store data at rest using 256-bit AES encryption and use an SSL/TLS secure tunnel to transfer data between your app and our API.

Our development follows industry-standard secure coding guidelines, such as those recommended by OWASP.

We conduct behavioural monitoring, vulnerability assessment, SIEM and intrusion detection to detect threats and keep our system safe and secure.

We have the pleasure of working with some of the most innovative fintechs in the world.

Get in touch or create an account.